3 Nationally Known Personal Finance Experts Take on 10 Critical Retirement Planning Challenges

Whatever life after 60 looks like to you, thinking about the money you’ll have – and how much you’ll need – during retirement shouldn’t keep you up at night.

Still, it’s hard not to obsess about the most worrying questions about money and aging:

How much can I really spend and how do I keep it from running out?

How can I grow my retirement nest egg without risking it all on stocks?

Should I sell my home and move to a less expensive locale, or simply downsize?

Am I ready to take charge of my finances if my spouse passes away?

And, what about the biggest and possibly most costly unknown: health care?

Who Do You Talk to About Money?

If you don’t have a financial advisor helping you sort through these issues and charting the right course, chances are you’re not discussing them with your spouse and children.

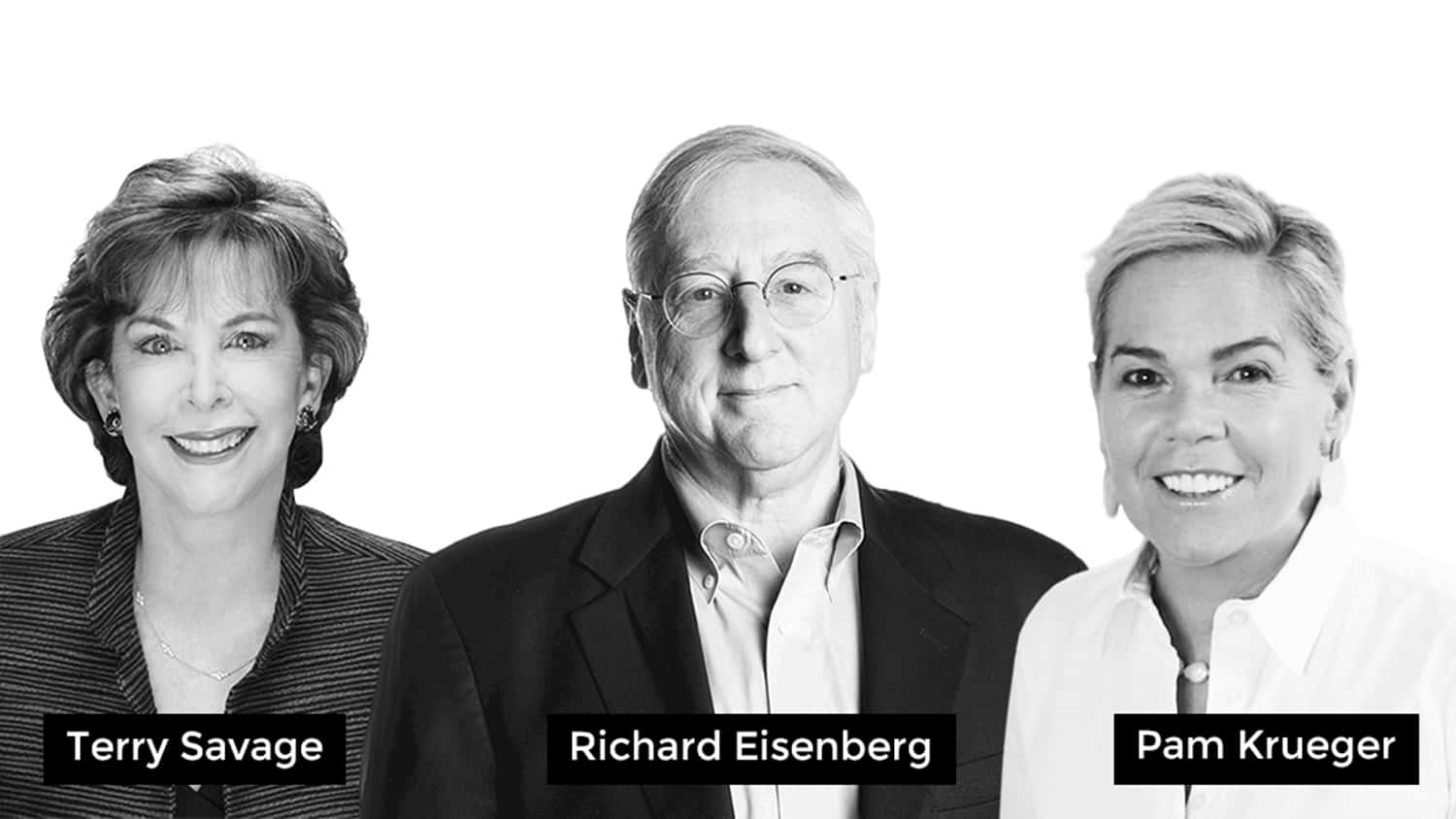

Nationally known personal financial journalists Pam Krueger and Terry Savage understand what you’re going through. That’s why they’ve teamed up with their friend Richard Eisenberg to bring you the benefit of their extensive experience in their new 10-part podcast series Friends Talk Money.

Introducing Friends Talking Money

According to Pam Krueger, whose online WealthRamp service matches investors with fully vetted fee-only fiduciary advisors, “Terry, Richard and I have been writing and speaking about retirement-related issues for decades. We created Friends Talking Money to share our collective insights and advice on ten vital issues that will give women over 60 the confidence they need to make solid financial decisions that will help make retirement the best, worry-free years of their lives.”

In each episode, the three friends will discuss and debate a specific topic featuring stories and insights from real investors and retirement planning experts. The series is underwritten by State Securities Regulators.

Is Your Advisor a True Partner of a Salesperson?

The kickoff episode exposes the many deceptive yet legal practices of glorified salespeople posing as financial educators and offers strategies on how to find a financial advisor who will act in your best interests–rather than theirs.

Future episodes will cover topics important to those about to retire or already retired such as: long-term care, elder fraud, managing debt, reverse mortgages, annuities, and the unique challenges facing women who outlive their husbands.

While Friends Talk Money may not answer all of your financial questions, you will walk away with a greater awareness of the retirement planning issues you’ll need to address with the help of your family, friends and financial counselors.

Tune into Friends Talk Money season one available on all your favorite podcast platforms.

What are your biggest money questions? Will you be tuning in to Friends Talk Money? Let’s have a conversation about this important topic.

Tags Retirement Planning