How to Improve Your Retirement Planning Literacy So Your Financial Planner Can Help You More

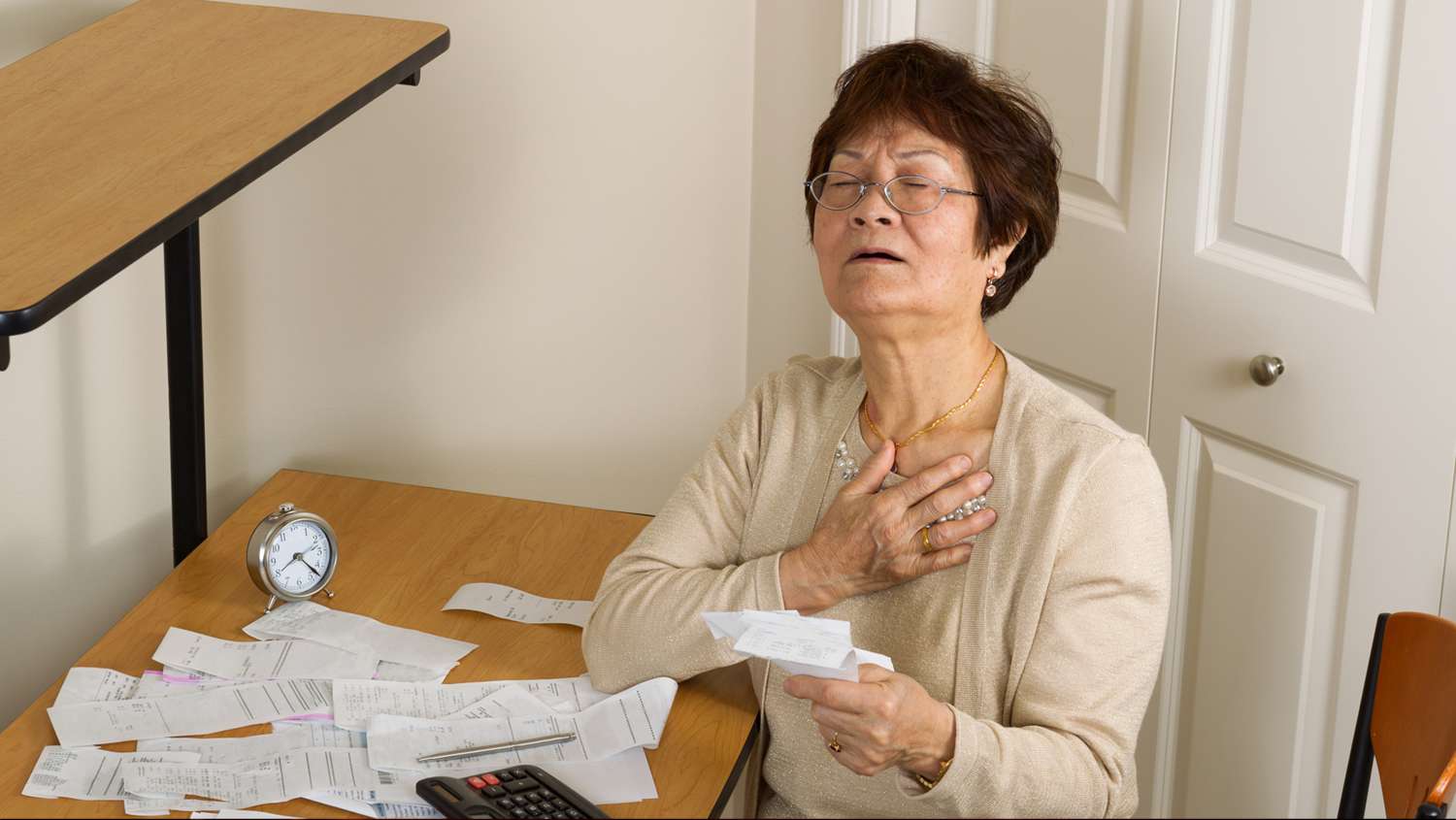

For most people, planning for retirement can be a daunting task. Some feel that financial advisers will talk down to them. Some are hesitant to open up about their retirement plans and financial woes. The thing is, preparing your finances and talking to an adviser are crucial steps for retirement. But it really doesn’t need to be so intimidating.

Join Margaret Manning as she talks with money expert Pam Krueger and financial adviser Beth Greulich about improving your financial literacy for retirement planning.

Learn the Basics of Financial Literacy

A Global Financial Literacy survey reports that financial literacy is lowest among adults aged 65 and above. This makes this age group more susceptible to significant costs such as debt and higher transaction fees and interest rates on loans.

Understanding basic financial concepts can help you avoid these financial traps. The goal of financial literacy is to preserve and protect your money rather than growing it. Moreover, it allows you to make informed financial decisions regarding investing, saving, and more.

Learn about the basic rules by asking questions and reading up on financial planning. Taking note of questions that will come out of your research would be helpful for your financial adviser to determine your needs.

Choose a Financial Adviser

One of the biggest concerns in the financial industry is how some advisers talk to clients as salespeople. That’s because some firms earn through products or commissions, which makes the transaction similar to another business deal. But that shouldn’t be the case.

When encountering financial advisers for the first time, ask them about their client retention rate. This will allow you to gauge how the adviser forms a relationship with their clients. After all, financial planning should be a collaboration and not a transaction.

Only a select number of financial advisers will care about your overall outlook. This 5% will listen to your concerns, engage you in conversation, and set proper expectations. After all, planning for retirement is not entirely about the money but about who you are as a person.

That is, you shouldn’t have to sign a 150-paged annuity if you don’t understand the content. The best financial advisers have access to more investments and are more open to answering seemingly mundane questions from clients.

The objective of a financial adviser should be to empower you through information and provide comfort by mapping out a financial plan that suits your needs. Instead of playing up to their firm, your financial planner should directly work for you.

Save for the Future

The general assumption is that retirees can withdraw 4% of their portfolio value over a 30-year period and not run out of money. But what about those who don’t have a million dollars to set aside for their retirement fund?

It’s never too late to start planning. There are investment options for low-income retirees and even for those who are facing retirement without any money at all.

Save up as early as now. If you can help it, make a habit of setting aside $50 to $100 a week. Finding the line between wants and needs is a good starting point.

Retirement doesn’t always turn out the way we envisioned. There are a lot of apprehensions, especially when you’re delving into financial planning for the first time. However, a good financial adviser will guide you through your apprehensions.

Have you planned for your retirement yet? If so, how did you manage it? Were you able to find a competent financial adviser? How was your experience working with them? Share your thoughts below!